How to Write an Invoice: Top 6 Tips for Crafting the Perfect Invoice

In this article, we will list our top five invoice tips, offering straightforward guidance on how to create a professional invoice that clearly indicates the goods or services being purchased—guaranteeing customers receive all the relevant and accurate information needed for them to make timely payments.

Invoices are a fundamental part of running any business, but creating an effective and correctly formatted invoice can feel overwhelming and time consuming.

Learning about the correct format to use for your invoices—as well as the information that should be included in every invoice—can help you save time and money.

In this article, we will list our top five invoice tips, offering straightforward guidance on how to create a professional invoice that clearly indicates the goods or services being purchased—guaranteeing customers receive all the relevant and accurate information needed for them to make timely payments.

Keep reading to learn how you can get started writing clear, accurate invoices today!

What is an Invoice?

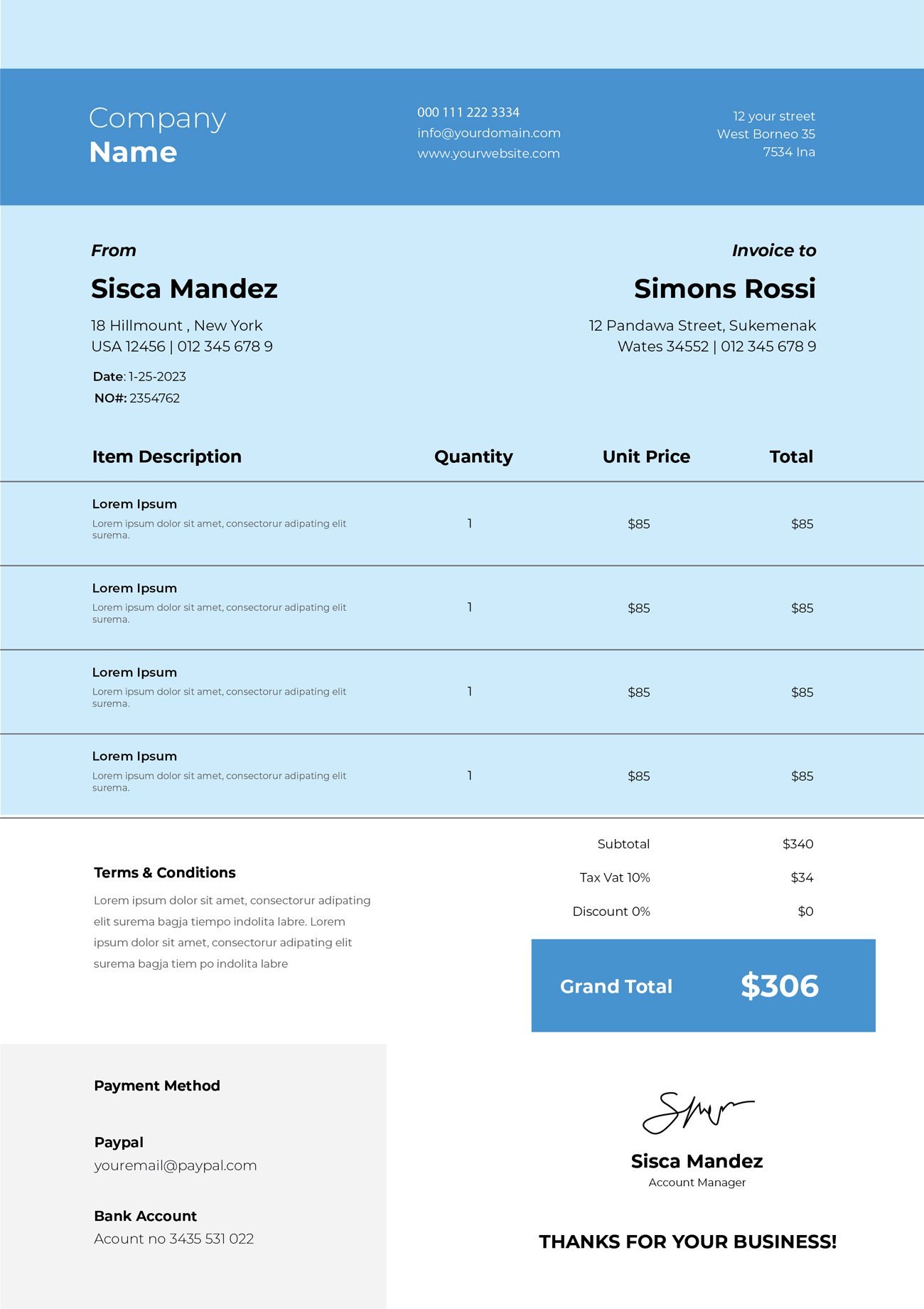

An invoice is an accounting statement that itemizes goods and services purchased by a customer from a seller. Generated at the time of sale or delivery, it serves to document the transfer of products or services, status of payment, and other pertinent information.

Invoices can be sent electronically, manually or through a system that integrates with business and accounting software. Acting as both a receipt and a request for payment, each invoice should include all components necessary to effectively document the transaction.

These components typically include identifying information about the parties involved in the purchase and sale, a description of what was purchased, pricing details about each product or service rendered, applicable taxes and discounts, and an overall total amount due.

The purpose of throwing invoices is to better keep track of accounts receivable to ensure timely payments are made by customers or clients.

1. Creating a Professional Layout

The format of your invoice is just as important as the information it contains. A professionally presented layout will be taken more seriously, making them easier to read and understand.

The layout should be kept consistent throughout your invoices to aid understanding and promote trust, which can help build strong business relationships with customers.

When designing the layout for your invoice, consider spacing and hierarchy of information, such as headings, subheadings and descriptions.

Some key considerations for creating a professional invoice layout include:

- Consistency - Use a consistent font and format for all invoices to maintain a professional appearance.

- Space - Leave plenty of white space to make the invoice easier to read and understand.

- Highlighting - Use bold text or highlighting to draw attention to important information, such as the total amount due.

- Logos - Consider including your company logo to further reinforce your brand and create a professional appearance.

Designing a simple and concise layout will make it easier for customers to quickly identify key elements - due dates, totals etc. This neat presentation combined with proper grammar and spelling goes a long way in creating a professional impression with clients.

2. Include All Relevant Contact Information

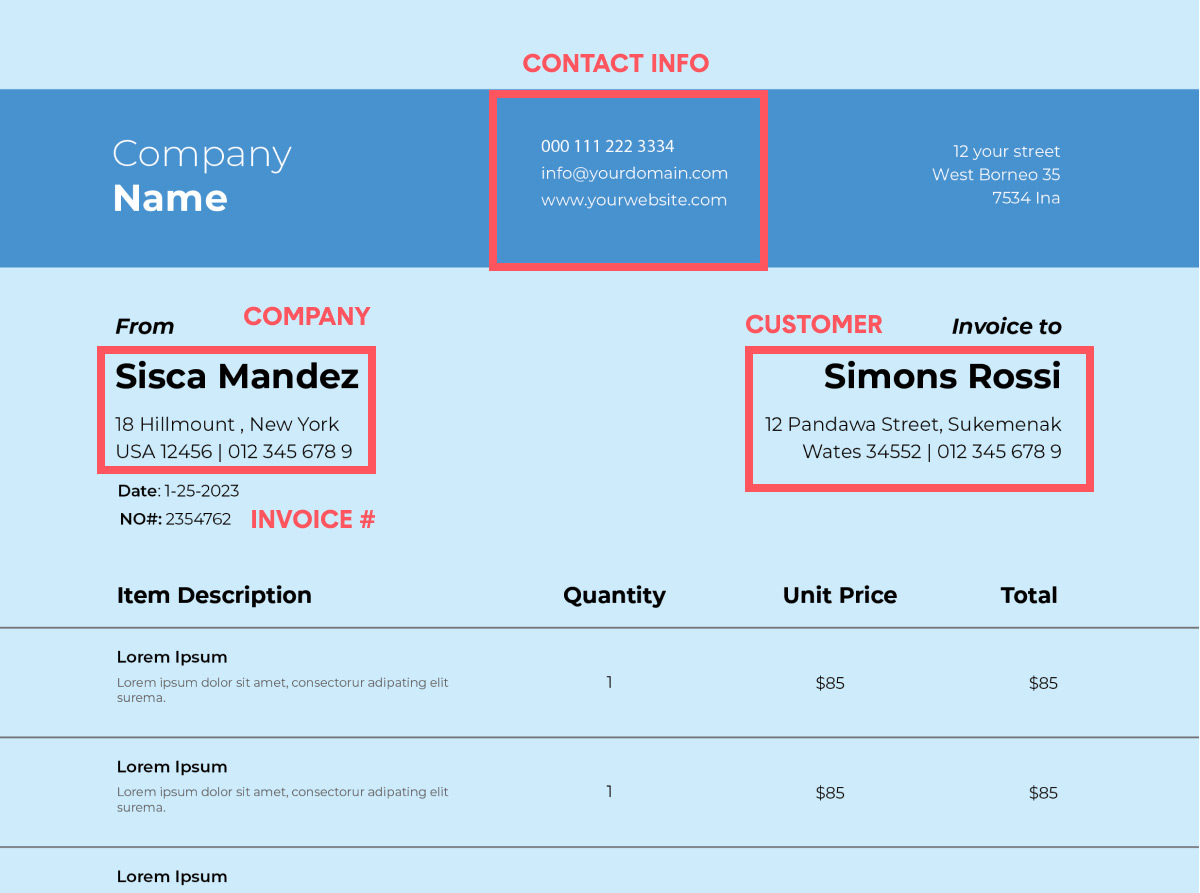

Including all relevant personal information, such as names, addresses, phone numbers and emails is an important part of creating an invoice. Without this information, the customer would have difficulty tracking their accounts and ensuring payment in a timely fashion.

Before you begin writing your invoice, it is important to understand the different components that make up a standard invoice. These components include:

- Company Information - This should include your business name, address, phone number, and email address.

- Customer Information - This should include your customer's name, address, and any relevant contact information.

- Invoice Number - This unique identifier should be used to track invoices and payments.

- Invoice Date - This is the date that the invoice was created and sent to the customer.

- Due Date - This is the date by which payment is expected to be received.

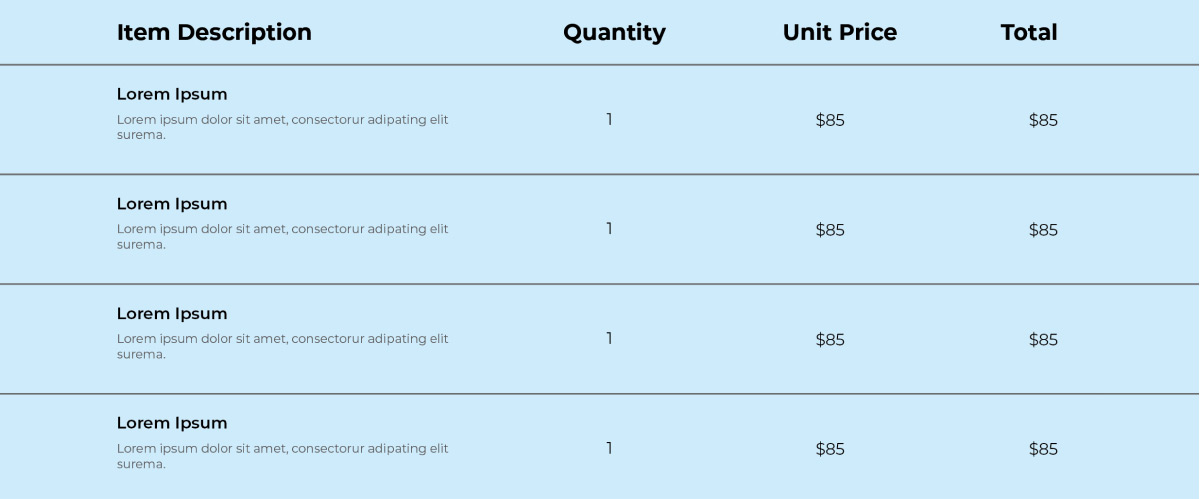

- Description of Services or Products - This should clearly and concisely describe the goods or services provided to the customer.

- Quantity - The number of goods or services provided should be clearly stated.

- Unit Price - The cost of each individual item should be clearly stated.

- Total Amount Due - This is the sum of all charges and should include any taxes or additional fees.

- Payment Terms - This section should specify the payment methods accepted by the business, such as credit card, PayPal, or check.

- Late Payment Fees - If applicable, this section should outline any fees associated with late payment.

- Signature - This is a space for the customer to sign, indicating their agreement to the terms outlined in the invoice.

Payment terms and methods, such as accepted forms of payment and any discounts for early payment. It's also good to include any other information that will help the customer understand the invoice and make payment, like a description of the goods or services provided, the quantity, and the price.

Additionally, having all relevant contact information for the customer and the person who is sending out the invoice allows for greater accuracy and efficiency in managing payments, while also providing a comprehensive audit trail regarding payments received, it also eliminates unnecessary gaps in communication between parties.

3. Add a Due Date and Payment Options

It is extremely important to include a due date and payment options. This ensures that both parties are aware of the timeline and the method in which payment must be made. This can often serve as a reminder to customers so they don't miss their deadline.

Specifying payment methods helps eliminate any confusion when it comes time to receiving payments, as customers may often have different preferences in terms of making payments. Establishing this information upfront will help ensure transactions move along smoothly; additionally, it can potentially increase customer satisfaction since all necessary details were discussed clearly from the onset.

There are several payment options that can be used for invoicing, including:

- Cash

- Check

- Credit card

- Debit card

- ACH (Automated Clearing House) or electronic bank transfer

- PayPal or other online payment systems

- Wire transfer

It is also possible to offer a combination of these payment options to your customers. It's important to clearly state the accepted payment methods on the invoice and also to provide instructions on how to make the payment.

4. Include an Itemized List of Your Fees

Define and spell out exact charges and taxes with an itemized list of invoiced fees to ensure customers understand the financial obligations they have taken on. Not only is this respectful of your customers, but it is also beneficial to both parties.

Transparency in billing operations provides trust and credibility in the customer-business relationship which encourages customer loyalty. Moreover, clarity in paper trails helps secure against any misunderstandings, potential audit issues, or future legal disputes while making compliance easier to understand across all channels.

An itemized list of fees gives both parties a clear understanding of what has been paid for and what remains pending through an organized approach.

5. Include a Unique Invoice Number

A unique invoice number can make a world of difference to businesses, providing clarity in tracking payments, tax organizing, and accounting more generally.

Failing to include an invoice number runs the risk of having invoices go un-matched with transactions, which is bad news for any finance department.

By having a clear and distinct invoice number, it is easier to accurately record payments and other associated data requirements like taxes and names.

Furthermore, matching the invoice numbers with banking reports will help businesses better organize their financial information for bookkeeping purposes from a general ledger point of view. Ultimately, assigning unique invoice numbers is essential in getting organized for proper tracking and accurate reporting.

6. Automating the Invoicing Process

Manually writing invoices can be time-consuming and prone to errors. Automating the invoicing process can help to streamline your business operations and reduce the risk of mistakes. Some popular invoicing tools include:

By utilizing these tools, you can save time, reduce errors, and create a more efficient invoicing process.

Conclusion

We hope these tips help you get started creating invoices for your company! If you’re still looking for ways to streamline the process of writing and sending invoices, consider invoice document automation as a solution for your company.

Documint can help save time and resources with its suite of tools for automating and creating your invoices.

By automating your invoices using Documint, businesses can experience significant benefits such as improved accuracy in billing information, reduced manual costs associated with data entry and compiling of invoices, increased staff efficiency and more—all while improving client relationships through faster communication and payment processing!

More blogs for you!

Revolutionizing HR: How Document Generation Software is Changing HR Teams

How Document Generation Software Transforms Commercial Real Estate

Automating Shipping Labels: A practical guide for Logistics and Supply Chain Leaders

Shipping labels are one of the most repetitive elements in logistics and fulfillment. Yet, despitefalse

You don’t need development skills to generate documents from your data automatically

Generate multiple documents and merge data in minutes without extensive development knowledge.